"Let's see. That house is 2,245 square feet and sold for $zzz,zzz. This house I am looking at is 1,960 square feet, 285 square feet smaller. At $46/sqft, I will lower my offer by $13,110."...Said no buyer of a SF, owner-occupied house, EVER!

Sure, buyers of commercial property do this all the time and x/square feet is right up there with income as the most important factor of a price. However, when families look at houses, they may glance at the square footage on the MLS sheet but their main motivation is, "this house looks a little bigger than the other one. Whattaya say, Hon, offer $10,000 more?"

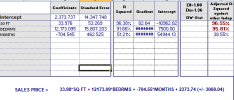

My point is, only residential appraisers, and to a lesser extent, listing brokers, put heavy emphasis on a sqft GLA adjustment. Sure, we have to because it is the best way to gauge what a buyer is thinking and if you have enough data, eventually you will find a notable pattern to get a reasonable, supportable range. Yet, ironically, the more we worry about how accurate our number is, the further we get from actually gauging buyer's motivations.