Phoenix Ashwalker

Freshman Member

- Joined

- Jul 4, 2023

- Professional Status

- Certified Residential Appraiser

- State

- Michigan

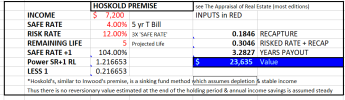

I'm working on a private report for a client to assist with the settlement of an estate. It includes a modest house with a total of 200+ acres of agricultural land, which is fine and nothing I haven't tackled before. However, one of the parcels is ~120 acres and includes a cell phone tower. While I've run into this a handful of times, in the past the tower's lease has been bought out and typically is considered a detriment to the property, rather than a benefit. In this case the tower still has an ongoing lease, with the potential for renewing the lease periodically.

My question then is how to properly discount the value of the tower's lease and potential income. For example, lets say the current lease has 5 years remaining, with a payout of $600 per month, and the option to renew for 3 additional 5 year periods. I don't believe I can simply take the current lease ($600 x 12 months x 5 years = $36,000) and give the tower a straight contributory value. And I certainly don't believe it would be correct to take the total potential payout over all renewal periods ($600 x 12 months x 20 years = $144,000).

Any advice? Anyone run into these often enough that they've come up with a way to give an accurate and fair value to them?

Thanks in advance!

My question then is how to properly discount the value of the tower's lease and potential income. For example, lets say the current lease has 5 years remaining, with a payout of $600 per month, and the option to renew for 3 additional 5 year periods. I don't believe I can simply take the current lease ($600 x 12 months x 5 years = $36,000) and give the tower a straight contributory value. And I certainly don't believe it would be correct to take the total potential payout over all renewal periods ($600 x 12 months x 20 years = $144,000).

Any advice? Anyone run into these often enough that they've come up with a way to give an accurate and fair value to them?

Thanks in advance!