- Joined

- Mar 11, 2008

- Professional Status

- Certified Residential Appraiser

- State

- Texas

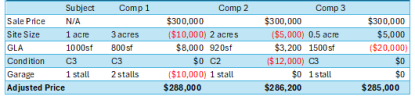

Great observation, but one that I would disagree with. The data set used (IMO) should always express a tighter adjusted range than raw range. If not, your adjustments are not 'working' (so to speak). Trying to imagine how this is possible... are you maybe saying that you use the large data set to extract your GLA adjustment, then apply it to the 'grid' data set (for example)?The sales on the grid are typically just a sample of a data set, so it is possible that they would widen, while the larger set of data from which the adjustments were developed would tighten. I am in agreement with what you're trying to say though. We shouldn't just plug adjustments in and then let the results speak; this is yet another reason why human judgment and expertise play an important role.