Digger88

Elite Member

- Joined

- May 11, 2010

- Professional Status

- Certified Residential Appraiser

- State

- Virginia

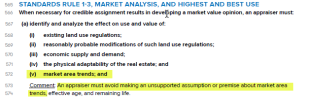

You don't have to buy anything. What you will have to do is support your opinions and conclusions within your appraisal report. Of course, there will be companies who make the job easier in exhange for some money. Remember though, USPAP doesn't support using 'black boxes'. The appraiser is required to understand how the analysis provided by the third party software is created. In other words, you could do it yourself... but, you choose to use the tool to save time.

I can see it now..

UW- Thank you for providing a detailed explanation of your methodologies and rationale in support of all your adjustments in the report. Please state how these methodologies and rationale were developed.