Interesting day, huh? I was listening to the radio last nite and the hourly news story was the Japan market dropped 10%, so I knew this morning would be interesting. So I decided to check on that alternate store of value: Bitcoin.

View attachment 89886

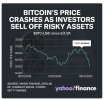

"Bitcoin (BTC-USD) is having its worst week since the collapse of Sam Bankman Fried’s FTX cryptocurrency exchange in November 2022.

The world’s largest cryptocurrency fell 14.85% through the week ending Saturday, according to Yahoo Finance data, before resuming its decline by another 7% over the last 24 hours amid a larger correction across all markets.

The price of the digital asset also briefly tumbled below $50,000 to its lowest price since February. It has lost more than $13,000 in value over the last seven days.

Ether (ETH-USD), the second-largest cryptocurrency, is absorbing even heavier losses. It fell more than 15% for the same 24-hour period, briefly seeing its biggest single-day drop since late 2021."

Bitcoin is having its worst week since the 2022 collapse of Sam Bankman Fried’s FTX cryptocurrency exchange amid a larger correction across all markets.

finance.yahoo.com

www.investopedia.com