shrubberyvaluation

Elite Member

- Joined

- May 2, 2012

- Professional Status

- Appraiser Trainee

- State

- Maryland

Its those greedy appraiser's fault people can't get cheap housing, oh yea and they are discriminating by appraising properties too low.One of Biden's campaign lines is "Inflation is coming down." The media dutifully repeats it, but they have the memory of a goldfish.

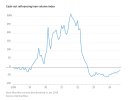

Cleveland's Fed Nowcast has February's Core CPI at 3.7%. So it is actually increasing, again and not 'approaching' 2%.

View attachment 85419