Bobby Bucks

Elite Member

- Joined

- Jan 27, 2002

- Professional Status

- Real Estate Agent or Broker

- State

- North Dakota

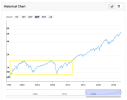

I saw an interesting forecast recently from an Elliott Wave chartist that has been more accurate than the vast majority of them lately. He thinks that the top is in for the year, a ~ 20% pullback in 2026, then a blowoff top in 2027.The thing is, the market is probably not too far from entering another box like that. It won't be exactly like last time, but a similar period of sub par gains will come. It wil not be going up at a rate of 20% per year forever.

This secular bull could be longer or shorter than last time. If it plays out the same as the last time, then we would have around five years left to the top and about a couple years before it enter the box.

I saw an interesting forecast recently from an Elliott Wave chartist that has been more accurate than the vast majority of them lately. He thinks that the top is in for the year, a ~ 20% pullback in 2026, then a blowoff top in 2027.

My guaranteed-to-be-wrong forecast is a rally to 7500 to end the year, 2026 being stagnant, then a strong 2027 to usher in a high inflation period that ends the bull for some time. Sentiment was quite frothy last year and there are plenty of doubters this year, so there is probably a political element *cough, Fernando* which could buoy the market for longer than it should.

Probably more realistic than 7500, with six weeks to go.I'm feeling like we end this year around $720.

Probably best to average purchases into the S&P while waiting for the next Bear & Bull markets.

View attachment 104933

Probably more realistic than 7500, with six weeks to go.