- Joined

- Mar 11, 2008

- Professional Status

- Certified Residential Appraiser

- State

- Texas

How much of that is attributable to market contraction and how much is attributable to a change in how consumers prefer doing their banking?

How much of that is attributable to market contraction and how much is attributable to a change in how consumers prefer doing their banking?

Yes, I am sure everyone - appraiser, regulator, and real estate expert alike - understands this concept perfectly....not.Back to the OP, the train is still coming. I really wish someone would pay a few boots on the ground appraiser bags of money to write papers on the subject or at least consult. Beyond the purist mentality of "if it can be measured it can be adjusted for" our big problem is Ph.D.'s and desk jokey appraisers have won the narrative and are riding whatever money train they can hop on. And boots on the ground appraisers had no chance to shape any of this, mostly because we have to actually work for a living and our orgs are filled with self-serving people who are just trying to pad their own nests with the ridiculous amounts of money pouring into our profession.

The carnage that will be left behind by people who spent millions on training classes that have no demand, or millions on software to drive adjustments and essentially the market, will just move on to the next gig. When we look back, for those left standing, this will be a niche skill with few practitioners making full time money.

Here's a study by the FHFA, notice not a single site sourced from any appraisal paper or org. And that's a flat-out failure of the orgs, especially the AI.

36 pages of BS to tell you the obvious, prices rise in spring and go flat by fall...sort of....depending...sometimes...

36 pages of BS to tell you the obvious, prices rise in spring and go flat by fall...sort of....depending...sometimes...Yeah, we've all heard the stories of buyers walking through single-unit residential dwellings with paper in hand scratching those calculations out before making offers.Yes, I am sure everyone - appraiser, regulator, and real estate expert alike - understands this concept perfectly....not.

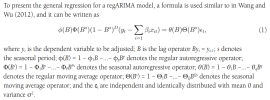

View attachment 9446536 pages of BS to tell you the obvious, prices rise in spring and go flat by fall...sort of....depending...sometimes...

I agree, ridiculous. But backed by more alphabet soup, phony-baloney regression, and money than we are. A LOT more. And not a single paper has been published by any appraisal org to refute anything Zillow. So in the future, who will pilot that adjustment train?The benchmark they use for the predicted adjustments is Zillow. Ridiculous.

Key finding: lenders are only concerned about time adjustments when the market is increasing