Underappraisal Disparities and Time Adjustments

Published:

01/16/2024

Several studies document racial and ethnic disparities in underappraisal. Racial disparities in appraisers’ use of time adjustments for local house price growth are one important factor driving these results.

Figure 1 suggests that time adjustments are an important determinant of underappraisal. Appraisers make time adjustments for only 19 percent of properties, outlined in red in the figure, but these adjustments are often the decisive factor in determining underappraisal (11 of 19 properties, as represented in the center green box). The non-decisive 8 of 19 properties are split evenly between appraisals for which the value is above contract even without the adjustment (4 percent in the green box), and those where adjustments are not large enough to increase the appraisal above the contract price (4 percent in the purple box). Another way to appreciate the importance of time adjustments is to note that 23 percent of properties are underappraised before time adjustments (three right-most boxes), but only 12 percent afterwards (two purple boxes).

Disparities in Time Adjustment and Underappraisal

During the period examined here, appraisers time adjusted at least one comparable property for only 18.5 percent of all properties being purchased, despite national house prices growing robustly during the entire period and very rapidly during 2021. Time adjustments are least common for homes in majority-Black tracts at only 13.4 percent, as opposed to 18.4 percent in majority-white tracts. In majority-Hispanic tracts and “no majority” tracts, there is no statistically significant difference from majority-white tracts. Hereafter, majority-Black tracts are referred to as Black tracts, majority-Hispanic tracts as Hispanic tracts, and so forth.

9

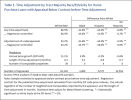

When we focus on appraisals below the contract price before time adjustments, larger disparities emerge. Table 1 shows that, among these appraisals, appraisers ultimately time adjust at a 67 percent rate in white tracts, but only at a 45 percent rate in Black tracts, a disparity of 22 percentage points. We see disparities of 14 and 7 percentage points when comparing Hispanic and no-majority tracts, respectively, to white tracts.

These simple comparisons of means understate the disparity because average annual house price growth, an important predictor of time adjustments, is 3 percentage points higher in Black tracts during this period (14%) as opposed to white tracts (11%). Two other important predictors, the length of time adjustment and the number of comparable properties available, are about the same. Regression analysis confirms that the disparities cannot be explained by these market conditions.

10 After regression adjustment, disparities increase in Black tracts to 25 percentage points, while remaining about the same in Hispanic and no-majority tracts. Thus, for potentially decisive time adjustments, disparities are considerably larger than in the full sample and affect homebuyers in Black, Hispanic, and no-majority tracts.

Further, examination of decisive time adjustments also shows large disparities. In white tracts, 52 percent of appraisals initially below the contract price rise above the contract price through time adjustment. However, this happens only 30 percent of the time in Black tracts, a disparity of 22 percentage points. The disparities are 17 and 10 percentage points, respectively, in Hispanic and no-majority tracts, compared to white tracts. Adding regression controls leads to little change in these figures.

Time adjustments can make the greatest difference for borrowers with appraisals initially below contract who are similar to the marginal borrowers that represent the focus of bank regulator compliance reviews and economic theory.

11,12 As marginal borrowers teeter between approval and denial, additional help can be decisive. The precarious situation for these borrowers is sometimes referenced in the “thick folder” theory of discrimination, where loan officers can choose whether to make an extra effort to assist the borrower in submitting additional documents to explain or compensate for any blemishes in their application.

13

Several studies document racial and ethnic disparities in underappraisal. Racial disparities in appraisers’ use of time adjustments for local house price growth are one important factor driving these results.

www.fhfa.gov

same old same old...racist appraisers