- Joined

- Feb 14, 2002

- Professional Status

- Certified Residential Appraiser

- State

- Louisiana

At the end of the day we should apply adjustments to features/conditions market participants are reacting to. Anyone who has participated as boots on the ground in real estate, as opposed to sitting behind a desk looking at numbers and never interacting in a meaningful way with people buying/selling real estate, know without question people react to features like location, functional utility, site size, living area, bathroom count, etc. It's not always easy to crunch the data, and there are times where polling participants is the only way to make sense of something. With that said, I find it hard to believe anyone in the buying/selling process would look back at a property they considered a few months ago and think "it's worth 1% more now" or look at a house they want to buy/sell now and think "I'll offer 1% or ask 1% more than the similar property that sold 3 months ago."

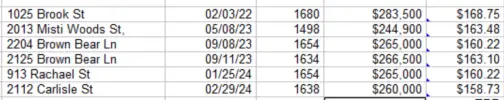

And even if you believe dumping data into excel is the end all and be all, you have no way of knowing why the trend was moving in one direction or the other (did a bunch of larger properties sell, or smaller properties sell?) if you don't spend time scrubbing the data. And that scrub should include an overall trend for a base then include only properties similar to the subject. And speaking of scrubbing the data, without isolating the comparable in the timeframe against similar properties as opposed to the overall market, you have no way of knowing if the comparable sold above, at, or below the trend (Comp 1 may be one of the extreme dots above/below the trend line). So, if you're plotting a regression line through a scatter graph/chart or xy plots, the comp should be isolated as one of those data points.

Overall IMO making a 1% adjustment on a comp that sold a few months ago doesn't add to the credibility of a residential appraisal report, except in extreme markets. I'm not saying market trends should be ignored, what I am saying is we don't need to look under every rock for adjustments or account for the fall of every sparrow in our reports. We're not pricing widgets, many (most?) times a property sells for +/-$X for reasons that can't be measured like emotion or just plain negotiation skills on one side or the other. In the illustration presented by Fannie, a proper reconciliation of the SCA would better serve credibility than a 1% time/market condition adjustment.

And even if you believe dumping data into excel is the end all and be all, you have no way of knowing why the trend was moving in one direction or the other (did a bunch of larger properties sell, or smaller properties sell?) if you don't spend time scrubbing the data. And that scrub should include an overall trend for a base then include only properties similar to the subject. And speaking of scrubbing the data, without isolating the comparable in the timeframe against similar properties as opposed to the overall market, you have no way of knowing if the comparable sold above, at, or below the trend (Comp 1 may be one of the extreme dots above/below the trend line). So, if you're plotting a regression line through a scatter graph/chart or xy plots, the comp should be isolated as one of those data points.

Overall IMO making a 1% adjustment on a comp that sold a few months ago doesn't add to the credibility of a residential appraisal report, except in extreme markets. I'm not saying market trends should be ignored, what I am saying is we don't need to look under every rock for adjustments or account for the fall of every sparrow in our reports. We're not pricing widgets, many (most?) times a property sells for +/-$X for reasons that can't be measured like emotion or just plain negotiation skills on one side or the other. In the illustration presented by Fannie, a proper reconciliation of the SCA would better serve credibility than a 1% time/market condition adjustment.

Last edited: