NJ Valuator

Senior Member

- Joined

- Feb 23, 2003

- Professional Status

- Certified Residential Appraiser

- State

- New Jersey

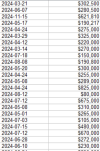

MLS allows you to download as a .csv file (comma separated value) which I then load into Excel. I eliminate most of the columns and then run a scatter chart and trendline.

is it possible to screen capture what it looks like after you load the file into Excel and show it here?