J Grant

Elite Member

- Joined

- Dec 9, 2003

- Professional Status

- Certified Residential Appraiser

- State

- Florida

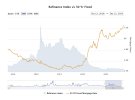

RE sells and re-finances happen in all economies, and often we see volume increase in a "bad" economy. It is mainly interest-rate-drivenIt’s the end of an era. fund rates from 0 to 5.5 and going up slowly to save the currency. By the next boom the clients/people/system will be different. This re-set of the monetary environment is the lowest volume I’ve had in 38 years (forever). It’s not just us. The entire economy has been supported by low rates and all investments were influenced by low rates. The dollar itself is incrementally losing its reserve power which allows the USA to be a cubicle working Starbucks drinking population and not a hard working pollution breathing, dying younger population. A 5.5 percent (normal) Fed funds rate will break the economy and the federal solvency so what’s going to happen? Many directions possible .. none good. Hyper inflation if they start up QE 6 and force rates down… depression if they allow the market to set rates.. decades long malaise stagflation …Global war to obfuscate and blur cause identity.

In the last 4 months 1.5 trillion in debt and during an economy the MSM keeps repeating is “strong”. Where is the tax revenue?

It will pick up, whenever rates come down. However, long-term and short-term appraisal volumes will be lower. A major factor is during the last low interest rate cycle a massive amount of folks refinanced and they are not going to refinance, perhaps ever. And having such a low rate makes these folks not want to sell , which lowers inventory and reduces our volume. Add in whatever % of waivers replace appraisals and more cash sales to investors and you have what we are witnessing,

Any younger appraisers who are worried ( younger means still young enough to change course regardless of actual age) may want to consider what they are doing or whether appraising is more feasible for them part-time rather than full-time as an income source. County assessor jobs might be an option.

Last edited: