Joe Flacco

Elite Member

- Joined

- Jul 31, 2013

- Professional Status

- Certified Residential Appraiser

- State

- Maryland

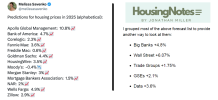

Taking Inventory Of 2025: Despite High Mortgage Rates, Housing Prices (And Sales) Expected To Rise - Housing Notes

Subscribe to ‘Housing Notes’ to receive Jonathan Miller’s weekly insights and research.