You capitalize income, not savings.

The fee the electric company is reimbursing homeowners for their electric generation, is what you capitalize.

Other "savings" are predicated on lifestyle usage, number of people in a home, yada, yada.

From Nevada.

How much does an average rooftop solar array cost?

Depending on size and output, typically between $15,000 and $30,000, but sometimes more. Customers who buy panels outright can be eligible for a federal incentive that provides a 30 percent tax credit on the panel price.

How much does the average homeowner save on his or her electric bill?

Under previous net metering rules, homeowners were expected to save 10 to 20 percent on their NV Energy bill. However, some solar customers have reported seeing their

bill as low as $5 during some months.

http://lasvegassun.com/news/2016/mar/28/are-brighter-days-ahead-for-solar-customers/

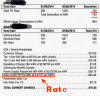

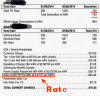

In red is the rate to work with. Generation decreases over the life of the panel. The RATE, in many places has DECREASED since 2009, is not written in stone and historically, has not survived more than one president, hence the risk of a reduced rate over the 20-25 year life span of the panels is far greater than a safe rate of liquidity.

If you are capitalizing $5 a month in Nevada over 25 years....................

The current political rhetoric not withstanding.................

Solar panels and net metering for solar panels was put in place until public utilities meet 30% renewable federal requirements. Federally there is no mandate to reimburse homeowners at retail rates for solar generation, and no requirement to reimburse homeowners at all, after the utility meets it's 30% renewable requirement - if they meet that requirement some other way, like frying birds in the desert, or giant commercial solar farms. If your state has a mandate to reimburse homeowners for solar generation at $X until 2036, go for it, you have little regulatory risk. Otherwise, consider what happened in Nevada as also going to happen at some point in California.

You must consider these as risk factors in your income calculation, even if the AI didn't

and caveated to a before Income tax analysis.

However, escalating real estate taxes, homeowner's insurance, maintenance (cleaning) costs, and verification of soundness of the electrical connections (already lots of home fires from solar panels) All have to be included in the expense of that income generation, even if the AI didn't

.

And at the end,

Removal and Disposal of the hazardous waste, in future dollars, including stripping the shingles and patching the mounting bolt holes in the sheathing.

Leaving you with a net present value of???? And still have to caveat to the manufactures that have gone out of business leaving homeowners without a company to service or warranty any issues, and those that have produced faulty panels that caused house fires.

But the rest of the country is not California.

.