-

Welcome to AppraisersForum.com, the premier online

community for the discussion of real estate appraisal. Register a free account to be able to post and unlock additional forums and features.

community for the discussion of real estate appraisal. Register a free account to be able to post and unlock additional forums and features.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Three days in a row. Different GLA than advertised.

- Thread starter Tim Hicks (Texas)

- Start date

ZZGAMAZZ

Elite Member

- Joined

- Jul 23, 2007

- Professional Status

- Certified Residential Appraiser

- State

- California

JG, TS, AB, et. al: it seems to me that a commonality exists among your comments, throughout this thread, despite that arguments for each perspective are compelling. What is equally interesting IMO are assumptions that your perspectives are obvious--but presuming that "obvious" pertains to "all intended users," I disagree, and betcha that 95% of all residential appraisers haven't for a second entertained the scope of thought that are expressed here. That having been said, should the practitioner address his or her perspective about the accuracy or application of the point value in the Reconciliation narrative, even briefly, or is this critical factor sufficiently addressed in embedded certs???Could have sworn there used to be a face plant emoji... I guess not. These will have to do.

- Joined

- Mar 11, 2008

- Professional Status

- Certified Residential Appraiser

- State

- Texas

Discourse is just that - discourse. Disagreement is not only ok, but expected - being able to defend one's position is what develops trust in their own position/thoughts. What is really tiresome is that some folks feel the need to have the last word - and will repeat their (often) incorrect propositions ad nauseum, eventually forcing the other debater to just throw their hands up - or try to find face plant emojis.JG, TS, AB, et. al: it seems to me that a commonality exists among your comments, throughout this thread, despite that arguments for each perspective are compelling. What is equally interesting IMO are assumptions that your perspectives are obvious--but presuming that "obvious" pertains to "all intended users," I disagree, and betcha that 95% of all residential appraisers haven't for a second entertained the scope of thought that are expressed here. That having been said, should the practitioner address his or her perspective about the accuracy or application of the point value in the Reconciliation narrative, even briefly, or is this critical factor sufficiently addressed in embedded certs???

- Joined

- Jun 27, 2017

- Professional Status

- Certified General Appraiser

- State

- California

JG, TS, AB, et. al: it seems to me that a commonality exists among your comments, throughout this thread, despite that arguments for each perspective are compelling. What is equally interesting IMO are assumptions that your perspectives are obvious--but presuming that "obvious" pertains to "all intended users," I disagree, and betcha that 95% of all residential appraisers haven't for a second entertained the scope of thought that are expressed here. That having been said, should the practitioner address his or her perspective about the accuracy or application of the point value in the Reconciliation narrative, even briefly, or is this critical factor sufficiently addressed in embedded certs???

In most cases, you must assign a point value as of the effective date. But nothing prevents the appraiser from also providing a range value. And, quite frankly, beyond providing a range for the effective date, you could also offer an interesting "most probable" value going forward, assuming average maintenance. You could also offer some alternate future values given certain black swan events. You could provide numerous projections and conditional ranges, which would likely leave the client in disbelief regarding the actual value. Of course, the accuracy of your predictions is significantly reduced as you move further into the future. - That's why the lenders and GSEs should require periodic home inspections every 8-10 years or so, especially if refinancing is required, and make sure that refinancing covers any needed repairs and maintenance, as under that assumption, the properties can be expected to hold their value better.

Artemis Fowl

Senior Member

- Joined

- Mar 16, 2004

- Professional Status

- Certified Residential Appraiser

- State

- Michigan

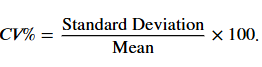

Coefficient of VarianceAB, I usually consider the width of the adjusted value range as a critical factor, i.e., the more narrow it is, the more obvious that the price point is. Question: is there a mathmatical expression to describe the width other than in absolute dollars, e.g., from $xxxx.o to $zzz.o, or $.....00? Can the width be described in relative terms, perhaps a ratio of some sort, or a variance percentage?

The coefficient of variation (CV) is a statistical measure of relative dispersion, calculated by dividing the standard deviation by the mean and multiplying by 100 to express it as a percentage. It is useful for comparing the variability of different datasets, especially when they have different units or vastly different means, as it provides a standardized, unitless measure of dispersion. A lower CV indicates less variability relative to the mean, suggesting more consistency.

Median or Mean Absolute Deviation is also a good way to analyze a sample. Distance from median/average of each sale price. Useful to help define neighborhoods, market areas or just outliers within a sample.

Last edited:

J Grant

Elite Member

- Joined

- Dec 9, 2003

- Professional Status

- Certified Residential Appraiser

- State

- Florida

Statistics uses large sets of data to get results. They are useful in appraisal to show trends such as market conditions or in some cases to derive adjustments. But as far as a statistical interval in a range - that might use hundreds or thousands of data points, and in real estate might use hundreds of data points, how does that translate to an appraisal using a very limited set of comps?

We are not hired as statistics, we are hired for our market knowledge and ability to distinguish among our comps and compare them to the subject in a meaningful manner..

In most residential appraisals, the adjusted value range uses between 3-6 comp sales ( typically.) I provide 4-5 comps in most reports. Whether it is 3, 4, 5, or 6 comps to get an adjusted range, it is a very small number of sales, thus comparing it to a large data set using confidence intervals around its point value is irrelevant, and it leads to the falsehood that in an appraisal, any number in the range is as valid as the next..

Peer practice is a USPAP standard. The majority of appraisers provide a supportable explanation of why they chose to reocnicle at X $ point value and usually address the specific comps receiving most weight or consideraion, as well as referencing market conditions and other factors. They do not just pick a dartboard choice with the rationale that any number in the adjusted range is as valid as another ( Ditto for a rote reliance on the sale price, or rote pick of the average or mean )

.

We are not hired as statistics, we are hired for our market knowledge and ability to distinguish among our comps and compare them to the subject in a meaningful manner..

In most residential appraisals, the adjusted value range uses between 3-6 comp sales ( typically.) I provide 4-5 comps in most reports. Whether it is 3, 4, 5, or 6 comps to get an adjusted range, it is a very small number of sales, thus comparing it to a large data set using confidence intervals around its point value is irrelevant, and it leads to the falsehood that in an appraisal, any number in the range is as valid as the next..

Peer practice is a USPAP standard. The majority of appraisers provide a supportable explanation of why they chose to reocnicle at X $ point value and usually address the specific comps receiving most weight or consideraion, as well as referencing market conditions and other factors. They do not just pick a dartboard choice with the rationale that any number in the adjusted range is as valid as another ( Ditto for a rote reliance on the sale price, or rote pick of the average or mean )

.

- Joined

- Mar 11, 2008

- Professional Status

- Certified Residential Appraiser

- State

- Texas

Citation, please.The majority of appraisers provide a supportable explanation of why they chose to reocnicle at X $ point value and usually address the specific comps receiving most weight or consideraion, as well as referencing market conditions and other factors.

J Grant

Elite Member

- Joined

- Dec 9, 2003

- Professional Status

- Certified Residential Appraiser

- State

- Florida

It is inane to ask for a citation since I do not have access to such a thing. My conclusion comes from having reviewed hundreds of appraisals ( and additional appraisals handed to me by RE agents and others at inspections ) and seeing their reconciling statements, as well as what posters here say and from reading appraisal texts and articles and guidelinesCitation, please.

I do not recall any recognized organization or continuing education appraisal texts saying any number in the adjusted range of the comps is as valid as another so pick any number.

- Joined

- Mar 11, 2008

- Professional Status

- Certified Residential Appraiser

- State

- Texas

Kinda what I thought. You pulled that statement right out of thin air.It is inane to ask for a citation since I do not have access to such a thing. My conclusion comes from having reviewed hundreds of appraisals ( and additional appraisals handed to me by RE agents and others at inspections ) and seeing their reconciling statements, as well as what posters here say and from reading appraisal texts and articles and guidelines

I do not recall any recognized organization or continuing education appraisal texts saying any number in the adjusted range of the comps is as valid as another so pick any number.