Joe Flacco

Elite Member

- Joined

- Jul 31, 2013

- Professional Status

- Certified Residential Appraiser

- State

- Maryland

Market is strongest where the high income buyers are buying. I'm not seeing anything down from 3 months ago.

Personally, I just report what the market says, not any one sale, and not bigger picture trends. I've never seen a property lose or gain 10% in one month, but there are likely segments in some areas of the country that recently went up ~50% over a 12-month period.I see the impact but market conditions can be misleading. No one made a 10% a month adjustment yet in the 2010-13 period I saw plenty of REOs sold, then flipped for huge profits and virtually no investment. So the chicken and egg problem was did the REO really become "market value" when first sold (if not, then it should never be used as a comp); or, was it "market value" when flipped? When looking at the big picture, prices increased far more modestly. The REOs were noise in the background, arbitraged sales of low priced REOs who were 'worth' far more but were being dumped onto a glutted market by banks who were told to clean up their balance sheets by the regulators.

That should be the case with every adjustment, no? I would say, it should not make the range substantially wider.. What I meant was, if you remove the time adjustment and apply all the others, then put the X time adjustment back in, it should serve its purpose of narrowing the range and bringing older sale date comp prices more in line with the recent.

totally agree, when you have lots of sales, measuring the current median value and comparing that to 60, 90 ago you have all the support you need. If you do not have sufficient sales then it is less credible.In an active urban or suburban market. It is probably the easiest and most accurate adjustment you can make.

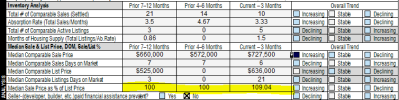

I hate that report, it's too broad and limited at the same time if done the way FNMA suggests. I would rather break things down by PPSF on a monthly basis and look at it for the market as a whole. I find when I do it this way you get a better picture and some months have dips but not as much as some would think, and some have huge increases that you would not expect to be there, while other areas saw somewhat steady increases. I actually had an area that was starting to show a decrease over the last few months that was significant and steady, but that is not everywhere. I have found lately it's easier to just check it, that way there are not such huge ranges for the adjusted values.View attachment 63441

This is what I typically see after the Spring which is represented by the current three month period. It clearly shows a more balance in the prior 4-12 month period and suddenly in the Spring you have prices being bid up an average of 10%. Seasonality at work and most of the price gains for the year occurring in the Spring. It is difficult to see it at the beginning of Spring if all you are looking at is price.

I make constant rate so reviewers can understand. Anything more complex and they won't understand.Ding, ding, ding! We have a winner! Appraisers when figuring out market adjustments always assume that it changes at a constant rate. This is how they get into trouble.

I make constant rate so reviewers can understand. Anything more complex and they won't understand.

I have seen this more than once. I am looking at a report which says "Sales older than 90 days were adjusted 1% per month to account for changes in market conditions".

Huh? Where on earth did the idea come from that you don't adjust for sales less than 90 days. It makes no sense in an increasing market. Does anybody know? As I mention, I have seen this on more than one occ

I hate that report, it's too broad and limited at the same time if done the way FNMA suggests. I would rather break things down by PPSF on a monthly basis and look at it for the market as a whole. I find when I do it this way you get a better picture and some months have dips but not as much as some would think, and some have huge increases that you would not expect to be there, while other areas saw somewhat steady increases. I actually had an area that was starting to show a decrease over the last few months that was significant and steady, but that is not everywhere. I have found lately it's easier to just check it, that way there are not such huge ranges for the adjusted values.

Many forumites don't understand me. How do you expect reviewers to understand?Of course you do