Joe Flacco

Elite Member

- Joined

- Jul 31, 2013

- Professional Status

- Certified Residential Appraiser

- State

- Maryland

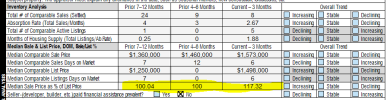

Look at this segment of a neighborhood. 80's and 90's homes on lot sizes less than 15,000 SF. Again shows seasonality at work and demonstrates how most of the price gains occur in the spring. More balance in the summer, fall, and winter, then all of a sudden sold for average of 17% over ask in the spring. 17% is obviously not a normal spring but it shows the significance of the spring market relative to other seasons.

End of spring and into summer, the sellers now know what the spring sale prices are, so the list prices are much higher now than it was in the spring.

Last edited: