Dublin ohio

Elite Member

- Joined

- Mar 20, 2008

- Professional Status

- Licensed Appraiser

- State

- Ohio

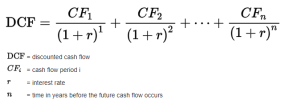

Homebuyer DCF.A sophisticated buyer or their paid analysist of commercial properties might use a GRM wrt choosing solar, but the average residential home buyer will not , that was my point.

Homebuyer: How much does it save on your electric bill. Homeowner or RE agent: $X. Homebuyer: Thank you