-

Welcome to AppraisersForum.com, the premier online

community for the discussion of real estate appraisal. Register a free account to be able to post and unlock additional forums and features.

community for the discussion of real estate appraisal. Register a free account to be able to post and unlock additional forums and features.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Where are the orders!

- Thread starter nycvalue

- Start date

- Status

- Not open for further replies.

- Joined

- May 2, 2002

- Professional Status

- Certified General Appraiser

- State

- Arkansas

It's not rocket surgeryNot everybody has what it takes to get a CG license

The worst problem is finding someone to mentor you and it was much easier 20 years ago. Many CGs are not old and are now unwilling to train unlike pre-Great Recession. The class work is not overly taxing. I passed the test first try and I think most would pass first or second try.

Essexfenwick

Member

- Joined

- Apr 24, 2020

- Professional Status

- Certified Residential Appraiser

- State

- Maryland

We are in the difficult “reset” period of the financial system which last happened in the early 80’s.

Inflation was similar to today although it was called higher because the formula was honest and not a manipulated bs formula of today. Inflation is double the fake news cpi and has been since the late 90s. The Fed knows that 3.5% is actually 7% cpi and people are feeling the stress and anger of reality.

So in the 80s mortgage interest rates were raised to 15 percent which caused a painful recession and a crappy appraisal market like today. Over the next 40 years the Fed manipulated rates up and down in an overall long term down pattern juicing the mortgage market in fear of rates going further up or the opportunity of a lower rate. By 2010 after multiple bailouts of economic sloppyness the Fed had rates at essentially zero. 2010-2022 rates were zero. Then the inflation of the money supply that had been inflating assets leaked into consumer goods at a tremendous rate so we are back in the early 80s stagflation engineered by slovenly government sponsored entities. Appraisers, mortgage guys rode the wave for 40 years. Now there is hopefully another painful reset that actually works (doubtful this time with the debt and spoiled population) that will set up the economy for another run. But I feel the FED will surrender to inflation which they can point fingers everywhere for blame rather than cause a deep recession necessary to fix an economy addicted to debt and zombie assets.

Inflation was similar to today although it was called higher because the formula was honest and not a manipulated bs formula of today. Inflation is double the fake news cpi and has been since the late 90s. The Fed knows that 3.5% is actually 7% cpi and people are feeling the stress and anger of reality.

So in the 80s mortgage interest rates were raised to 15 percent which caused a painful recession and a crappy appraisal market like today. Over the next 40 years the Fed manipulated rates up and down in an overall long term down pattern juicing the mortgage market in fear of rates going further up or the opportunity of a lower rate. By 2010 after multiple bailouts of economic sloppyness the Fed had rates at essentially zero. 2010-2022 rates were zero. Then the inflation of the money supply that had been inflating assets leaked into consumer goods at a tremendous rate so we are back in the early 80s stagflation engineered by slovenly government sponsored entities. Appraisers, mortgage guys rode the wave for 40 years. Now there is hopefully another painful reset that actually works (doubtful this time with the debt and spoiled population) that will set up the economy for another run. But I feel the FED will surrender to inflation which they can point fingers everywhere for blame rather than cause a deep recession necessary to fix an economy addicted to debt and zombie assets.

djd09

Elite Member

- Joined

- May 20, 2009

- Professional Status

- Licensed Appraiser

- State

- Ohio

Get out of appraising and go sell courses on how to market for appraisals and you can be rich like Dustin Harris. Thank you Andrew Cuomo

after all these years...we are still being bent over by crooked coumo

Joe Flacco

Elite Member

- Joined

- Jul 31, 2013

- Professional Status

- Certified Residential Appraiser

- State

- Maryland

We are in the difficult “reset” period of the financial system which last happened in the early 80’s.

Inflation was similar to today although it was called higher because the formula was honest and not a manipulated bs formula of today. Inflation is double the fake news cpi and has been since the late 90s. The Fed knows that 3.5% is actually 7% cpi and people are feeling the stress and anger of reality.

So in the 80s mortgage interest rates were raised to 15 percent which caused a painful recession and a crappy appraisal market like today. Over the next 40 years the Fed manipulated rates up and down in an overall long term down pattern juicing the mortgage market in fear of rates going further up or the opportunity of a lower rate. By 2010 after multiple bailouts of economic sloppyness the Fed had rates at essentially zero. 2010-2022 rates were zero. Then the inflation of the money supply that had been inflating assets leaked into consumer goods at a tremendous rate so we are back in the early 80s stagflation engineered by slovenly government sponsored entities. Appraisers, mortgage guys rode the wave for 40 years. Now there is hopefully another painful reset that actually works (doubtful this time with the debt and spoiled population) that will set up the economy for another run. But I feel the FED will surrender to inflation which they can point fingers everywhere for blame rather than cause a deep recession necessary to fix an economy addicted to debt and zombie assets.

It's not the 80's. It is like the 50's.

History shows this balancing act of checking inflation and managing growth resulting in a increasing trend in rates can last a long time.

No different than the balancing act that caused rates to decline for 40 years.

gregb

Elite Member

- Joined

- Sep 3, 2011

- Professional Status

- Certified General Appraiser

- State

- California

Joe Flacco

Elite Member

- Joined

- Jul 31, 2013

- Professional Status

- Certified Residential Appraiser

- State

- Maryland

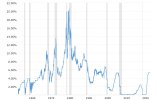

Fed funds rate - 62 year historical chart

View attachment 88154

Where the fed funds rate is they are trying pretty hard to prevent the 70's-80's. Remains to been if they will be successful.

Joe Flacco

Elite Member

- Joined

- Jul 31, 2013

- Professional Status

- Certified Residential Appraiser

- State

- Maryland

Sufficiently restrictive.

djd09

Elite Member

- Joined

- May 20, 2009

- Professional Status

- Licensed Appraiser

- State

- Ohio

Plenty of appraisal work here, partially due to CA appraiser numbers declining from 20,120 in 2010 to current number of 8,812.

you do work in marin city...

- Status

- Not open for further replies.