Joe Flacco

Elite Member

- Joined

- Jul 31, 2013

- Professional Status

- Certified Residential Appraiser

- State

- Maryland

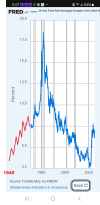

QE was by its very definition designed to lower interest rates. Rates were at 50+ Year lows, and you can literally see on the chart where the the Fed started buying treasuries in 2008-2020

View attachment 97880

If you take the chart back 40 more years, it looks like this.

What happened then was the Federal Reserve pegged short-term treasuries at 3/8% and capped long-term bonds at 2.5% to finance WWII. This was the policy in place between 1942 and 1951.

QE did keep the rate low, but what should have they done? Because of QE we got a great recession and 10 years of slow 2% gdp growth rate instead of great depression 2.0.

I think I kind of understand why you would say it was artificially low. I guess what I am saying is that it was not a mistake and the rate was where it was supposed to be.