- Joined

- Apr 4, 2007

- Professional Status

- Certified Residential Appraiser

- State

- Tennessee

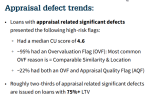

You have posted that multiple times, but that is not what their newsletter actually said. That reference was actually 95% of appraisal reports identified as having appraisal related significant defects. It was not 95% of appraisals. Pretty big difference.Now, according to Fannie Mae, 95% of the appraisals they receive are overvalued.

Last edited: