Standards I – Sponsored By Zillow

BY

JONATHAN MILLER · PUBLISHED NOVEMBER 9, 2020 · UPDATED JU

My appraisal firm is a member of the Industry Advisory Council (IAC) of the Appraisal Foundation (TAF). I’ve presented to IAC in Washington and the people I’ve met at IAC are great. Before I get to Zillow, here are my thoughts about the structure of the TAF councils:

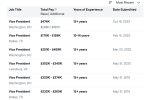

IAC = Pay to Play. In order to see how the sausage is made,

members pay $2,500 per year to buy access to TAF executives, board chairs, and various staff. Members pay their way to the IAC meetings across the county, probably spending $10k to $15K annually. I only attended the meetings when they were in DC but each of those trips cost me about $1,500 round trip. I am not making the argument here that these companies shouldn’t have access to TAF, but it shouldn’t be on a pay to play basis. It is corporate elitism at its worst.

TAFAC = free. The other council is for private organizations, trade groups, individuals, and government agencies. There is no fee for these members, just travel costs. More importantly, TAFAC has wasted more than a decade with the bitter feud between Dave Bunton and the Appraisal Institute. But now, as Kelly Davids has said, AI and TAF are going to make beautiful music together?

I have mixed feelings about the set up of these two councils. How can a publicly accountable organization like TAF, require a fee from the private sector? Is ‘pay to play’ really appropriate for a non-profit that has government oversight?

In addition, the IAC is comprised of many AMCs, National mortgage companies because they can afford the costs. My firm’s membership appears to be an outlier in that regard.

Let’s Look At Zillow as a new IAC member

Here are some additional thoughts on Zillow’s IAC membership:

- Zillow seems to be using TAF to build credibility as a valuation source when its valuation reputation is poor. TAF just wants the money.

- Zillow seems to be the only IAC member that is NOT an appraiser or appraisal provider. TAF just wants the money.

And the most important consideration for IAC’s mistake in judgment is that because Dave Bunton is steering TAF away from accepting ASC grant money as Congress intended, they will become much more dependent on funds from other sources such as IAC members and Corporate sponsorships, continuing to shift away from their mission.

The Zillow decision and TAF’s actions are completely inappropriate for an organization that is supposed to protect the public trust.

Yesterday I received this feedback from TAF/IAC: The voting process was completed for Zillow Group and they were approved as an IAC member with the

appraisersblogs.com

hey Frank...pay to play