chad hampton

Elite Member

- Joined

- Nov 10, 2006

- Professional Status

- Certified Residential Appraiser

- State

- North Carolina

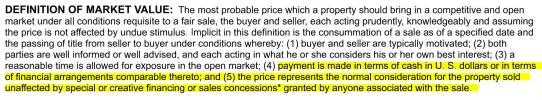

So how do you identify a waiver since JG contends there is no way to do that

I can’t, and that’s the problem. Most of the residential appraisals we do are most likely contributing to the problem because of the data cancer that we have no choice but to use.