They are not going to measure the house, just regurgitate the obvious....from the assessors measurements or the MLS. I bet a high percent of these "inspections" won't involve a drive by at all, simply mining the MLS and assessor for info. So the "desktop" appraisal will be based on a "desktop" inspection.

measuring is not the issue.

The issue is that real estate borrowing is cyclical. How do AMCs and the lenders that own or affiliate with them make money in a down cycle?

How do AMCs and Lenders that own or affiliate with them "grow" profits?

When inspectors take 2-3 days to take and send photos,

nobody has saved any "time" in this process. And specifically because appraisers have

requirements to verify the information, this garbage SHOULD TAKE LONGER FOR THE APPRAISER TO VERIFY, instead of just seeing it the first time, themselves.

Oh but look, it's still an appraisal with an interior inspection so no "discount" is due to borrowers who paid for "interior appraisals".

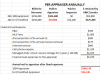

So, let's play some math.

In Anyplace USA there are 10 residential Appraisers that complete 22 appraisals a month, each. There are no loans that require appraisals and no appraiser can be found to perform them.

100% of the loans for property are being funded by appraisals performed by one of the 10 appraisers in Anyplace. The Annual Appraisal volume for Anyplace USA is 2,640 appraisal orders.

Now here comes the bi-f/hybrid. (Personally I think bi-f is a more appropriate name, because of the double F indicated, but let's see what the math says.

So, if there is a decline in lending and appraisal volume, The volume of appraisals ordered, would be able to decline 57.9% before the AMC/Lender lost one penny from the decline, - if they used all bi-f appraisals instead of ordering all 1004 appraisals.

But with a 59.7% decline in appraisal ordering most appraisers would just stop doing residential lending appraisals, and do something else until another day. But AMCs are one trick ponies, so they need to find a way to survive such a downturn in volume, especially with PIWs picking up.

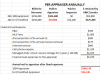

So let's say that the market does not decline in appraisal volume and Anyplace USA still generates 2,640 appraisal orders annually that are being serviced by 10 appraisers.

If we could move all appraisal orders to bi-f appraisals,

we can greatly increase profits to the lender and AMC,

but that is not incentive for anyone to come buy a house or to refinance a house.

So the volume of work remains the same.

Look what happens to the appraisers.

I don''t know too many people that can survive on $14,330 and still pay the electric, water, sewer bills and buy groceries, unless they are on social security or receiving welfare. And that welfare is not going to allow deductions from gross pay for those things listed above as fixed expenses.

So, if lenders can get all appraisals to be bi-f instead of 1004s, look what it does to annual gross to the AMC/Lender

Now you see why it is so important to AMCs to get appraisers to "accept" bi-f work.

And let's not talk about an appraiser shortage, because if all that work goes bi-f, 8 out of 10 current appraisers, won't have any reports to do.

.