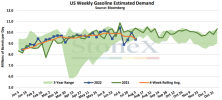

Standard Chartered this week released a commodity alert that said that this year, driving season in the U.S. never really materialized. The report noted substantial demand declines for both June and July, adding, however, that the recent price decline should result in a pick-up in demand this month.

There has been a lot of talk about the cure for higher oil prices being higher prices still. It appears this might have happened in the U.S. as prices for gasoline earlier this year hit the highest level in several decades.

Actually they may be higher. Summer driving demand for gasoline was over estimated and refiners shifted production to maximize gasoline only to see gasoline reserves increase as diesel stock piles (and prices at the pump) are well over the price of gasoline by as much as $1.50 or more)

“Diesel stocks have declined for the past year a half and are down by nearly 70 million barrels, to the lowest level since 2014,"

The refiners, now realizing there will be no "summer driving season", are going to be shifting gasoline production to produce more diesel and lower the cost of diesel while gasoline is likely to see a modest increase.

Demand destruction also is an indicator that vacations have been curtailed or "staycations" with perhaps some taking late vacations with prices falling. This is not a good thing for the common summer driving destinations like the Rockies. It will be interesting to see tourism numbers. People have been stuck home for 2 years and the urge to travel has been stifled by the price of travel.

The crude prices now are almost fully "Risk Off" when it comes to the geopolitical edge. Russia, contrary to expectations, is selling plenty of oil on the international market. Europe cannot wean themselves off natural gas nor diesel from Russia. China and India have ramped up millions of barrels of purchases and that has freed the world supply to meet the demands of the world. This places crude oil at about $20-30 above when Biden came into power and we are unlikely to see prices fall significantly more unless the economy falls flat on its face. The next 3 months are critical as housing has slumped and consumer buying has weakened.

www.westernjournal.com

www.westernjournal.com

www.westernjournal.com

www.westernjournal.com