Here's a quick-n-dirty comparo between high LTV vs 0-low LTV sales in a bland subdivision. Full disclosure, I'm personally familiar with this particular neighborhood since I actually grew up there. My parents sold and left 20 years ago, though; so I'm not afraid for my wife and kids.

View attachment 95181

View attachment 95182

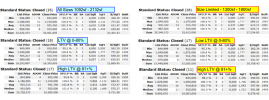

What this is: I used my MLS and manually searched all the listings for their reported financing to sift between the sales with all-cash or low LTVs, among which there may or may not be some waiver usage; vs the 81-100% LTVs which would presumably include zero GSE waivers during 2024.

The subdivision in question was built in the 1950s and originally consisted of homes generally ranging from 1100-1500sf, however many of the units have since been enlarged. Remodels and pools and other add-ons will be common.

The composition of the over/under 80% LTV datasets don't entirely match as the high LTV set consists of larger homes and a larger median size. So I thinned the dataset by size (1300-1800 sf) so that they both at least shared the same size range. Nevertheless, the high LTV dataset still has a larger median size (1522sf vs 1360sf).

I didn't adjust by date of sale or any other relevant factor except for the sizes.

For the all-sizes dataset the median price for all of them was $915k, $912k for the low LTVs and $920k for the High LTVs, but again the median sizes are different.

For the size-restricted dataset the median prices were the same @915k for all of them, the low-LTVs and the high LTVs. The median for the size-restricted is the same as for the all-sizes datasets.

What any of this means (TO ME) is inconclusive without getting deeper into the individual condition factors like remodels and additional features. It might be possible, but I wouldn't arbitrarily assume that the physical features attributes of both of the financing tranches are super similar. Maybe so, maybe not.

Personally, I would have expected bigger differences in the median prices when the median sizes are different, and perhaps that does indicate to some data cancer among the low-LTV sales.