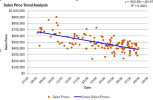

Looking at real estate trends using just sale prices over time can really give you the wrong idea about what’s happening in the market. One big problem is that the properties being sold at any given time aren’t all the same. If you don’t consider the differences in property characteristics—like size, condition, age, or even if a home was recently renovated—you’re likely to end up with a very skewed perspective.

Think about it: if a bunch of fully remodeled, luxury homes sell this year, but last year most of the sales were smaller, older homes, it might look like prices are skyrocketing. But in reality, it’s not that every property is suddenly worth more—it's just that more expensive homes are dominating the sales. The opposite is true too. If more fixer-uppers hit the market during a certain period, prices might look like they’re dropping when, really, they’re just reflecting the condition of the homes being sold.

That’s why it’s so important to dig deeper and account for these differences. Using tools like multi-variable regression can help because they look at how things like size, age, and features affect prices, while also accounting for trends over time—even if those trends aren’t perfectly straight lines. It’s a way to separate what’s happening with property values from what’s just noise in the data. Otherwise, you’re really just guessing based on surface-level patterns, and that can lead to some pretty misleading conclusions.

Yeah, much like when they introduced the 1004MC Fannie has no clue what they are doing.