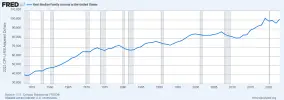

While it’s true that median real household income in the U.S. has increased by approximately 2.5x since the early 1950s and median real home prices have risen by about 2x, attributing the rise in home prices solely to the prevalence of dual-income households oversimplifies a complex issue and ignores several critical factors.

The argument that dual incomes drive higher home prices assumes that increased household income directly translates to proportional increases in housing demand and prices. However, this overlooks the role of supply constraints, such as rising construction costs, which have significantly driven up home prices independent of income trends. Additionally, the affordability comparison to the 1950s fails to account for changes in financing costs mortgage interest rates, which were lower in the 1950s (around 4-5%), compared to recent peaks near 7-8% and the increased burden of other household expenses like healthcare, education, and childcare, which consume a larger share of income today. Furthermore, the reliance on dual incomes to achieve affordability highlights a structural issue: single-income households, which were more common in the 1950s, now face significantly worse affordability, as median home prices relative to single incomes are far less favorable. Regional disparities also muddy the waters, as high-demand urban markets have seen price increases far exceeding the national median, driven by speculative investment and limited inventory rather than just dual-income purchasing power. Thus, while dual incomes contribute to demand, they are more a response to rising home prices and broader economic pressures than the primary cause, and affordability remains strained for many despite the slight improvement in nominal metrics since the 1950s.

Then you have to factor in the China high that we have been in since the 2000s that we did not have in the 1950s.