Mejappz

Elite Member

- Joined

- Dec 16, 2005

- Professional Status

- Certified Residential Appraiser

- State

- Florida

Be cautious about who you do business with. True Footage may be one of Fannie's preferred partners, but they face serious issues with the states.

appraisalbuzz.com

appraisalbuzz.com

On the New Time Adjustment Requirements - Appraisal Buzz

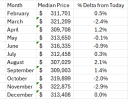

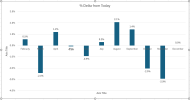

If you’ve completed an appraisal in the past week, you'll want to hear this. The GSEs' new time adjustment requirements went into effect on February 4th.

Last edited: