Liss of True Footage appears to blame appraisers for homeowners being out of the market. Is this person an appraiser? Why is True Footage promoting its product so aggressively?

According to John Liss, the CEO and founder of True Footage, the new selling guide requirements “could bring back thousands of deals that die due to low appraisal.”

“About 10% of appraisals come in under the contract price. Many of those were incorrectly low,” Liss wrote. “The number one reason an appraisal comes in low when it shouldn’t have is because the appraiser failed to make a time adjustment.”

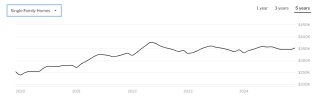

Time adjustments are a part of an appraiser’s analysis when he or she take the comparables sold in the past and brings them to present value.

“In 2021, in Austin, that July to December adjustment could have been 20%. In spite of record acceleration, appraisers were only making time adjustments 10% of the time. If you did not make that 20% time adjustment in July, you would never get the right contract price, because the December value would appear above market,” Liss said.

Liss believes the new mandated time adjustments have the ability to being “tens of thousands” of homeowners back to the market.

The FHFA report comes as the appraisal industry has been plagued for years by accusations of racial bias.

According to John Liss, the CEO and founder of True Footage, the new selling guide requirements “could bring back thousands of deals that die due to low appraisal.”

“About 10% of appraisals come in under the contract price. Many of those were incorrectly low,” Liss wrote. “The number one reason an appraisal comes in low when it shouldn’t have is because the appraiser failed to make a time adjustment.”

Time adjustments are a part of an appraiser’s analysis when he or she take the comparables sold in the past and brings them to present value.

“In 2021, in Austin, that July to December adjustment could have been 20%. In spite of record acceleration, appraisers were only making time adjustments 10% of the time. If you did not make that 20% time adjustment in July, you would never get the right contract price, because the December value would appear above market,” Liss said.

Liss believes the new mandated time adjustments have the ability to bring “tens of thousands” of homeowners back to the market.

The FHFA report comes as the appraisal industry has been plagued for years by accusations of racial bias.